I learned today that FlipKart is owned 80% by investors. That is a sad state of affairs. Investors should have the discipline to not own 35-40% of a tech startup, otherwise you are killing the hen that lays the golden egg. It is racism to think Indian tech startup founders can get by with little ownership because, well, they are Indian and they are in India.

I wish FlipKart all the best, but I can't see how a tech startup that is so weak at its foundation can be a trailblazer. It has been set to fall, if not now then later. The ownership structure is bull.

Rahul Yadav is another story that caught my attention months ago. The Indian media made it look like the guy sent out one wrong, arrogant email and that is why. That is missing the point. He had all the inklings of a tech startup founder. But the ownership structure there also was all messed up. And I gather Housing.com has bombed since. The hen got killed.

The Real Rahul Yadav Story

Rahul Yadav Has A Bright Future

I hope there will be a second coming of Rahul Yadav just like there was a second coming of Steve Jobs.

If FlipKart is owned 80% by investors, I am not sure it is the Indian Alibaba.

Saudi Arabia: SuperPower?

A tech startup founder is not a CEO. A tech startup founder has to be in a commanding position. Because you have to make drastic moves as you grow. And you need power to be able to make those moves. And the power comes from equity ownership. I don't know what the FlipKart investors are thinking.

A company owned 80% by investors, when it goes for its next round of funding, the investors will make the call. The founder CEO will not be at the negotiating table. That should never happen. An irrelevant founder CEO is not a founder CEO but an employee.

Tech Startup Equity Distribution

Zuck, Free Basics, India

Zuck, Free Basics, India (2)

Dorsey Ouster Was DNA Damage At Twitter

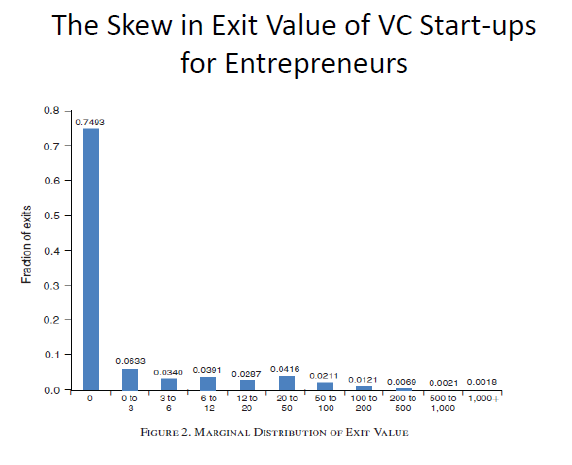

There is venture capital. And then there is vulture capital.

I wish FlipKart all the best, but I can't see how a tech startup that is so weak at its foundation can be a trailblazer. It has been set to fall, if not now then later. The ownership structure is bull.

Rahul Yadav is another story that caught my attention months ago. The Indian media made it look like the guy sent out one wrong, arrogant email and that is why. That is missing the point. He had all the inklings of a tech startup founder. But the ownership structure there also was all messed up. And I gather Housing.com has bombed since. The hen got killed.

The Real Rahul Yadav Story

Rahul Yadav Has A Bright Future

I hope there will be a second coming of Rahul Yadav just like there was a second coming of Steve Jobs.

If FlipKart is owned 80% by investors, I am not sure it is the Indian Alibaba.

Saudi Arabia: SuperPower?

A tech startup founder is not a CEO. A tech startup founder has to be in a commanding position. Because you have to make drastic moves as you grow. And you need power to be able to make those moves. And the power comes from equity ownership. I don't know what the FlipKart investors are thinking.

A company owned 80% by investors, when it goes for its next round of funding, the investors will make the call. The founder CEO will not be at the negotiating table. That should never happen. An irrelevant founder CEO is not a founder CEO but an employee.

Tech Startup Equity Distribution

Zuck, Free Basics, India

Zuck, Free Basics, India (2)

Dorsey Ouster Was DNA Damage At Twitter

There is venture capital. And then there is vulture capital.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/5938487/StarryStation-Print-01.0.jpg)